Once again we’re witnessing the risk of trading in a news-driven market. Stocks started out strong this morning but international news courtesy of Israel/Iran has derailed the nascent rally. This is rather unfortunate as both bullish ideas were off to a good start earlier and are now weakening along with the rest of the market. We want to reiterate that we can only take from the markets what they offer us. Technically speaking, we think there was a little more rally in the tank but it is clear that stocks easily become bothered by news which we simply can’t foresee. In other words, stocks aren’t taking news in stride and finding a way to selloff. Rallies are being sold off on poor news developments that seem to break every day. Clearly, this is much different than what we observed during stronger phases and thus we need to be prudent in these latter stages of a bull market. If it’s not there, it’s not there and we need to remain dynamic in our approach.

More specifically…

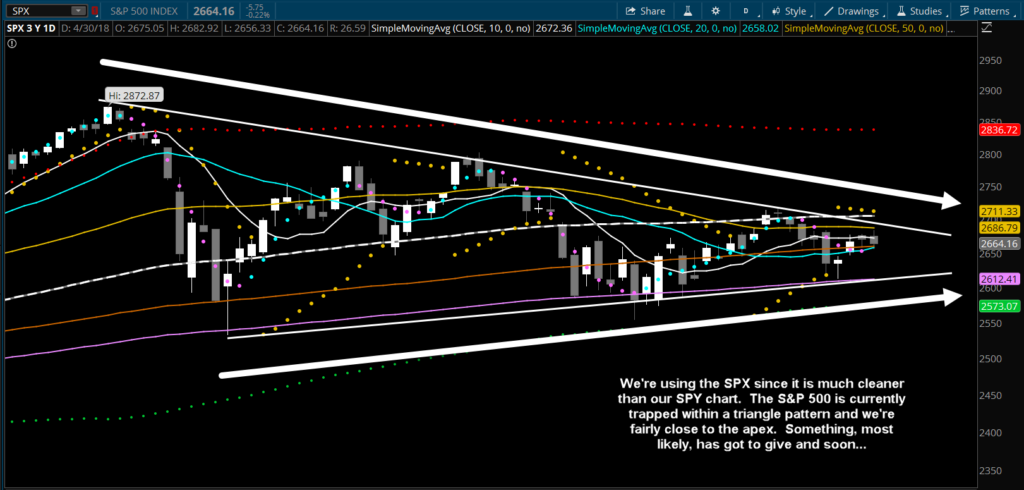

The SPYs are trapped between both multiple forms of resistance and multiple forms of support. However, they’re very close to breaking below support after performing so poorly after their promising start. Bulls will be called upon again to lift stocks or face yet another visit of the 200 SMA. But that’s not all:

The large corrective triangle pattern is quite obvious for all to see and it portends significant movement potential for the market. It shouldn’t be too long before the price action tries to move beyond key support or resistance. Thus, there’s quite a bit of risk as a result. The news cycle needs to flip to the positive side or a visit of the 200 SMA and support nearby it will be under attack in the not so distant future…

Thanks,

Wayne Razzi